The savings banks have always had the densest branch network in Germany. Every third branch of a financial services provider is a savings bank branch. That has always been true and is still true today. But the market is in a state of upheaval. All institutions are thinning out their branch networks. Most recently, Commerzbank made headlines when it announced the closure of over 300 locations in 2021, half of its branch network.

Even the savings banks, which according to their own advertising are always where the people are, have to look at costs. Savings banks have been merging for years. In 2000 , there were still a total of 562 savings banks in Germany. Currently, there are only 367 savings banks! The merger often means that branches are closed.But even without a merger, locations are being closed. Increasingly, branches are being converted into self-service centers (SB) without staff.

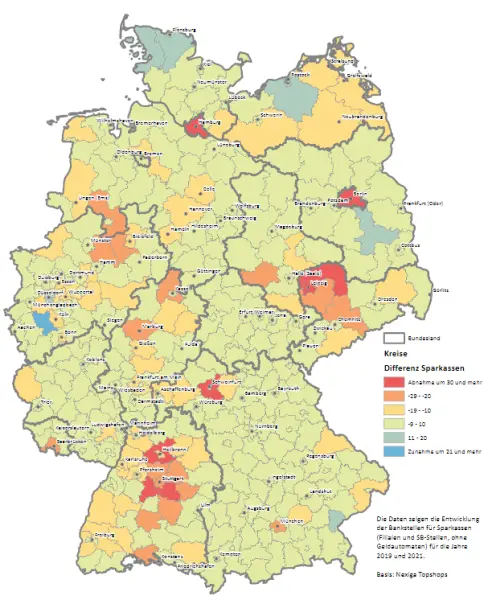

In1990, there were still more than 19,000 Sparkasse branches; in 2017, there were 13,300. In 2019, shortly before the outbreak of the Corona pandemic, only 11,000 branches and 3,700 self-service centers remain.

Today, the Sparkasse-Finanzgruppe has around 13,000 locations in Germany. Of these, fewer than 9,000 are traditional staffed offices, branches or advisory centers. Around 4,000 locations now function only as self-service points with banking terminals. There are also around 13,000 ATM locations.

Other Nexiga solutions from the financial sector are interesting in this context.

The trend: digitization

There are reasons for the reduction of bank branches across all institutions. In addition to costs, it plays a role that in the age of digitization, visiting the financial institution in person is simply no longer necessary. In aninternal survey- carried out back in 2014 - of the access channels used by its customers, HypoVereinsbank found that the number of branch visits is declining. The average customer visits a bank branch once a year to make personal contact. This is compounded by the use of self-service zones and all other channel options. For example, the number of Internet visits was over 280 and the number of call center contacts was 90. In addition, money was withdrawn from ATMs 50 times.

It's true that many customers still go to a bank branch or savings bank(learn more). There are still people who don't want to do everything online or in the self-service zone and who value personal contact. But the trend is toward online banking. And Corona, along with the digitalization push triggered by the pandemic, will reinforce this trend.